by Daniel Wilson

6 December 2021

This is because lifetime gifts may not fall within your estate for the purposes of IHT.

What are lifetime gifts?

The surviving parties who are able to make such claims are: Lifetimes gifts can either be gifts that have value in the form of either cash or personal assets or it can be a loss in value when transferring an asset (i.e. selling a property to a family member for lower than the asking price) where the gift would be deemed the difference between the market value and the sale price of the asset.

Any gift made, for the purposes of IHT, falls within any one of the three groups:

- An exempt transfer

- A potentially exempt transfer

- A chargeable lifetime transfer

Exempt Transfer

Exempt transfers are gifts which are deemed to be exempt and do not fall inside the estate for the purposes of IHT, these include:

- gifts to one’s spouse or civil partner (where for IHT purposes both of you are domiciled in the UK or both of you are domiciled outside the UK);

- gifts to UK, EU, Norwegian, Icelandic and Liechtenstein charities;

- gifts to UK political parties;

- gifts to housing associations or registered social landlords;

- gifts for national purposes (e.g. to a UK museum or gallery which exists wholly or mainly to preserve a collection of scientific, historic or artistic interest for the public benefit; or to a library whose main function is to serve the teaching and research needs at a university in the UK);

- gifts to heritage maintenance funds whose trustees are UK resident;

- gifts of shares to an employee benefit trust;

- gifts out of ‘normal expenditure’ (i.e. they form part of the donor’s normal expenditure out of their income, provided the donor is left with sufficient income to maintain their usual standard of living);

- small gifts (collective value £250 or less) to any person (provided no other exemption applicable) each tax year;

- wedding and civil partnership gifts. The amount depends on the relationship of the donor to the couple. Each parent can give £5,000, each grandparent (or remoter ancestor) can give £2,500, either of the couple can give to each other £2,500, any other person can give £1,000; and

- any other gifts, the collective value of which can be up to £3,000 each tax year. If the annual exemption is (wholly or partly) unused for a particular tax year, the unused portion may be carried forward for one tax year only.

The effect of an exempt transfer is that the gift falls outside of the estate and lowers the total estate value, making the estate’s potential tax liability lower.

Potentially Exempt Transfer (‘PET’)

PETs are any other gifts to individuals or certain favoured classes of trust which are not otherwise exempt and are called “potentially” exempt, because if the donor survives for seven years from the date of the gift, the gift becomes fully exempt. Should the donor not survive during the initial seven years, IHT will be payable on the gift.

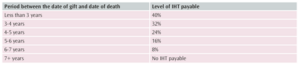

Taper Relief (the 7 year rule) As alluded to above, IHT would become payable on PETs in the event the donor fails to survive the initial seven years. Notwithstanding this, the level of tax payable will be reduced after 3 years and each consecutive year thereafter until the seventh year. An illustration of this relief can be seen below:

Gifts with Reservation of Benefit

There are times when an individual wishes to leave a gift behind but still wishes to enjoy use of the gift whilst alive – these are defined as gifts with reservation of benefit and it remains as part of their estate for the purposes of calculating IHT. As a result, IHT will be payable at the date of death on any such gifts.

Chargeable Lifetime Transfer

A chargeable lifetime transfer is in effect a transfer of value (generally in the form of gifts to property trusts or companies) that are immediately chargeable to IHT unless it is deemed an exempt transfer or PET. The level of tax payable for lifetime transfers above an individual’s Nil Rate Band is 20%.

A typical example of when this may arise is if a trust is created and a sum is transferred into the trust. This transfer can create an immediate charge which is 20% of the total value of the transfer. There may be, depending on the type of trust, anniversary charges for IHT. Upon exit from the trust, the remaining 20% of IHT could be payable.

The information contained in this update is for general information purposes only and is not legal advice, which will depend on your specific circumstances.

Speak with us